What Killed Antigua & Barbuda’s CBI Real Estate Option?

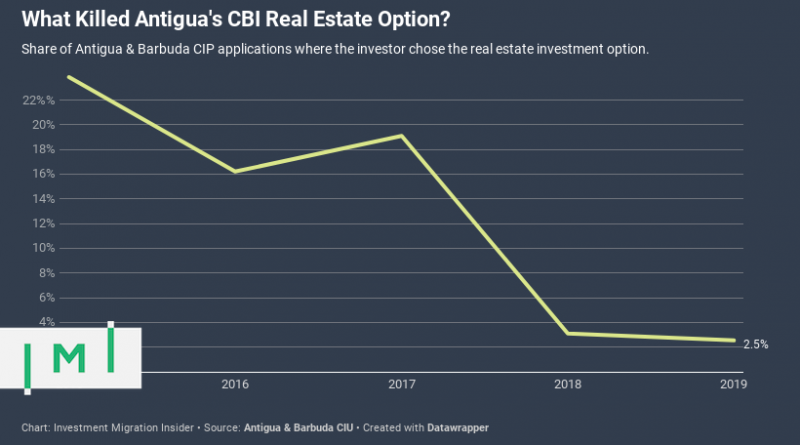

Between 2015 and 2017, one in five investors chose the real estate option. In the last two years, only one in forty did. Why?

All five Caribbean citizenship by investment programs have both donation and real estate investment options. Four of them have similarly priced real estate investment requirements. Three programs regularly report statistics.

But only two programs – the CIPs of Grenada and Antigua & Barbuda – publish data on how many applicants picked the particular investment options.

Because only two programs release investment category data, the only other real estate option with which we can compare that of Antigua is that of Grenada. And the difference in performance between the two programs’ real estate options over the last several years is remarkable.

The Antigua & Barbuda CIP reduced its real estate investment requirement from US$400,000 to US$200,000 in May 2018 (technically, it allowed for the co-investment, but the practical effect was a price halving), nearly a year before Grenada did the same, so a temporary price differential would not explain the diverging performance of the two programs.

If anything, it does the opposite; Grenada was last among its Caribbean peers to introduce the co-investment solution, and its real estate option was the region’s priciest – at US$350,000 – between May 2018 and March 2019. Notwithstanding the price premium, nearly a third of all of Grenada’s applicants in 2018 chose real estate over donations.

Is it that Grenada has more international-brand CBI developments than Antigua & Barbuda? This may be part of the answer, but not in itself enough to account for such a large discrepancy in performance.

If detailed data on investment/contribution choices among applicants in the CIPs of Saint Kitts & Nevis, Dominica, and Saint Lucia were available, what would they tell us? Is the demise of the real estate option a phenomenon that’s limited to Antigua or is it prevalent elsewhere as well?

Does the spread between the cost of real estate and donation – especially in relation to government fees and discounting improprieties – have anything to do with it? The astute (and jaded) reader might draw conclusions in that direction.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine – online or offline – for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.