Service Employees International Union-United Healthcare Workers West (SEIU-UHW) has filed a ballot initiative seeking a one-time 5% tax on California residents worth $1 billion or more.

California’s Attorney General recently listed the measure on the state’s official ballot website. The proposal aims to raise $100 billion over five years to address projected federal healthcare funding cuts.

Proponents Jim Mangia and Suzanne Jimenez filed the measure in October. The tax would apply to net worth as of December 31, 2026, targeting approximately 200 billionaires who collectively hold an estimated $2 trillion in wealth according to union figures.

Clients’ Discount “One Time” Promise

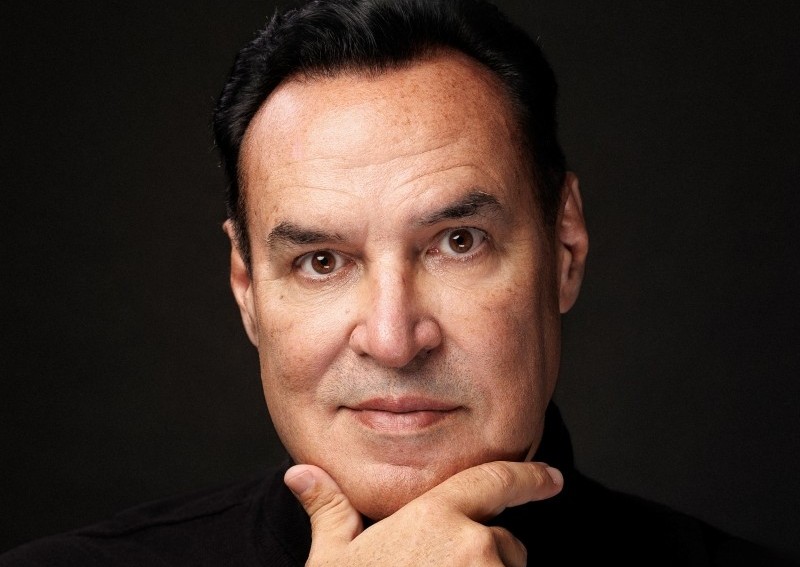

David Lesperance, Managing Director of Lesperance & Associates, reports that his California clients have already initiated departure strategies. His clients immediately exclude “the term ‘one time’ from their considerations,” viewing the proposal through the lens of Senator Elizabeth Warren’s “Ultra-Millionaire Tax” that targeted taxpayers worth $30 million or more.

Proponents structured the initiative with residency and anti-avoidance mechanisms spanning 2025 and 2026. The measure does not automatically tax all 2025 residents who relocate before the assessment date.

Timing creates a substantial window for departure. California’s Attorney General must draft the referendum question, supporters must collect 870,000 signatures by spring 2026, and voters would decide the measure in November 2026.

“If passed, rules on retroactivity make it highly unlikely that it could apply to assets any earlier than 2026 and more likely 2027,” Lesperance explains.

Wealthy residents are relocating based solely on the proposal’s existence. “With this whiff of Tax the Rich smoke, the targets are bolting from California now,” Lesperance observes.

Healthcare Funding Crisis Drives Proposal

The measure responds to projected federal healthcare funding reductions. Analysts estimate tens of billions in annual cuts to California’s Medicaid program under the One Big Beautiful Bill Act signed by President Donald Trump earlier this year.

SEIU-UHW president Dave Regan argues the tax addresses an emergency, warning that without action, “millions of people are going to lose health care, an untold number of people will go without treatment, and there will be tragedy after tragedy,” according to Newsweek reporting.

The initiative directs 90% of revenue to healthcare programs and 10% to education. The measure caps annual distributions at $25 billion through a dedicated reserve account established in the California Constitution.

Top 1% Already Contribute 39% of State Revenue

Lesperance warns the initiative creates what he terms an “own goal” for California. “With the top 1% of California taxpayers contributing 39% of the annual tax take, this proposal is already an ‘own goal,'” he argues. He predicts “no windfall but rather a permanent drop in existing tax revenues.”

Census Bureau data shows California lost more residents than any other state between 2023 and 2024. High-profile departures already include Elon Musk relocating Tesla and SpaceX to Texas, Oracle moving to Austin, and Hewlett-Packard shifting to Houston.

Newsom Opposes Union Measure

Governor Gavin Newsom opposes the measure publicly. The Democratic governor has labeled it “bad policy” and “another attempt to grab money for special purposes,” according to Politico reporting. Dan Newman and Brian Brokaw, political strategists who previously worked on Newsom’s ballot campaigns, established a “Stop the Squeeze” committee funded by business and tech leaders to fight the proposal.

How the Tax Would Work

The measure applies the tax to virtually all asset classes. Publicly traded securities, private company equity, business interests, trusts, art, collectibles, and intellectual property all fall within scope. Real property held directly by taxpayers or through revocable trusts receives an exemption.

Business valuations would use book value plus 7.5 times average annual profits over three years. Taxpayers could contest these figures through certified appraisals demonstrating clear and convincing evidence of different values.

Penalties for substantial understatement reach 20% of underpaid amounts. Gross understatement penalties climb to 40%. An understatement qualifies as substantial when exceeding $1 million or 20% of the tax shown on returns.

Potential targets include Meta CEO Mark Zuckerberg, worth approximately $209 billion according to Forbes estimates. Google co-founders Larry Page and Sergey Brin, Oracle’s Larry Ellison, and Nvidia CEO Jensen Huang are believed to maintain California residency.

Federal Tax Policy Concerns Accelerate Planning

The proposal has catalyzed thinking beyond state borders. “This proposal has made clients also realize that if the Democrats win the trifecta in November 2028, then Elizabeth Warren, Ron Wyden, and AOC will be in charge of US tax policy,” Lesperance notes. Clients “are making plans to not only move out of California but to escape the US tax system altogether.”

This creates potential demand for citizenship by investment programs offering tax advantages. Caribbean programs, Portuguese residency options, and Gulf state alternatives with territorial tax systems attract American attention.

Multiple Prior Wealth Tax Attempts Failed

Emmanuel Saez, a University of California Berkeley economics professor who advised on the proposal, believes the initiative has “a very good shot at passing,” according to the San Francisco Standard.

The union’s organizing experience and internal polling suggest strong voter support, though SEIU-UHW has declined to release specific numbers, according to Lexology.

California legislators have introduced and abandoned multiple wealth tax proposals over the past five years. Assembly Bills 259, 2289, 310, and 2088 all died without passage.

The initiative includes mechanisms for liquidity-constrained taxpayers. Optional Deferral Accounts allow individuals whose liquid publicly traded assets fall short of tax liabilities to attach illiquid holdings. Material distributions from these accounts over time would trigger proportional tax payments.

Taxpayers may satisfy obligations immediately or through five annual installments. Deferred payments accrue a 7.5% annual charge on remaining balances.

Wealth Tax Momentum Builds Nationally

Robert Reich, former Labor Secretary under President Bill Clinton, has endorsed the measure as “a wealth tax that will work.” Reich argues California’s approach could establish a blueprint for other jurisdictions.

Similar movements are emerging elsewhere. New York City mayor-elect Zohran Mamdani campaigned on a 2% millionaire income tax surcharge. The Democratic Socialists’ platform echoes broader progressive momentum around taxing concentrated wealth.

Academic debate surrounds implementation feasibility. National Bureau of Economic Research findings from Sweden and Denmark show one percentage point wealth tax increases correlate with 2% outward migration among wealthy taxpayers.

California’s Franchise Tax Board estimated $200 million to $300 million in annual administrative costs for a previous 1.5% billionaire wealth tax proposal under Assembly Bill 259. The current initiative allocates just $15 million annually for administration.

Constitutional Challenges Expected

Constitutional challenges will likely emerge if voters approve the measure. Legal experts at McDermott Will & Emery argue retroactive taxation potentially violates California due process protections, according to Inside SALT.

Proponents must collect 874,641 valid signatures by late April 2026. The measure requires only a simple majority of voters for passage in the November 2026 election.

The December 26 deadline approaches for California’s Attorney General to issue the official circulating title and summary. Signature gathering will begin immediately upon approval.

Newsom faces pressure from competing constituencies. Tech industry supporters oppose wealth taxation while union allies back aggressive revenue measures. The tension reflects broader Democratic Party divisions between progressive and centrist factions.

Florida, Texas, Nevada, and Washington State lead destination choices for California departees, according to California Globe. These states impose no personal income tax and have positioned themselves as business-friendly alternatives.